This is the income tax guide for the year of assessment 2019. Tax Offences And Penalties In Malaysia.

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

HR Block has been approved by the California Tax Education Council to offer The HR Block Income Tax Course CTEC 1040-QE-2355 which fulfills the 60-hour qualifying.

. If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat Reader. Online is defined as an individual income tax DIY return non-preparer signed that was prepared online either e-filed or printed not including returns prepared through desktop software or FFA prepared. Any delay beyond July 31 can attract interest on the.

They administer direct taxation acts passed by the Indian Parliament. By authorizing HR Block to e-file your tax return or by taking the completed return to file you are accepting the return and are obligated to pay all fees when due. Overpaid Taxes Can Be Refunded In The Form Of A Tax Return.

The deadline to file the Income Tax Returns ended on Sunday July 31. For further information on tax treaties refer also to the Treasury Departments Tax Treaty Documents page. For the assessment year 2022-23 as many as 58288962 people have filed Income Tax Returns so far.

You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. Filing an amended tax return with the IRS is a straightforward process. Income Tax Officers assess your financial documents assets and liabilities to determine your accurate income when you file an income tax return ITR.

Alex Cheong Pui Yin - 14th April 2022. According to the Income Tax Rules failing to file your income tax return by the deadline may result in a Rs 10000 fine and other penalties. You can file an amended tax return to make the correction.

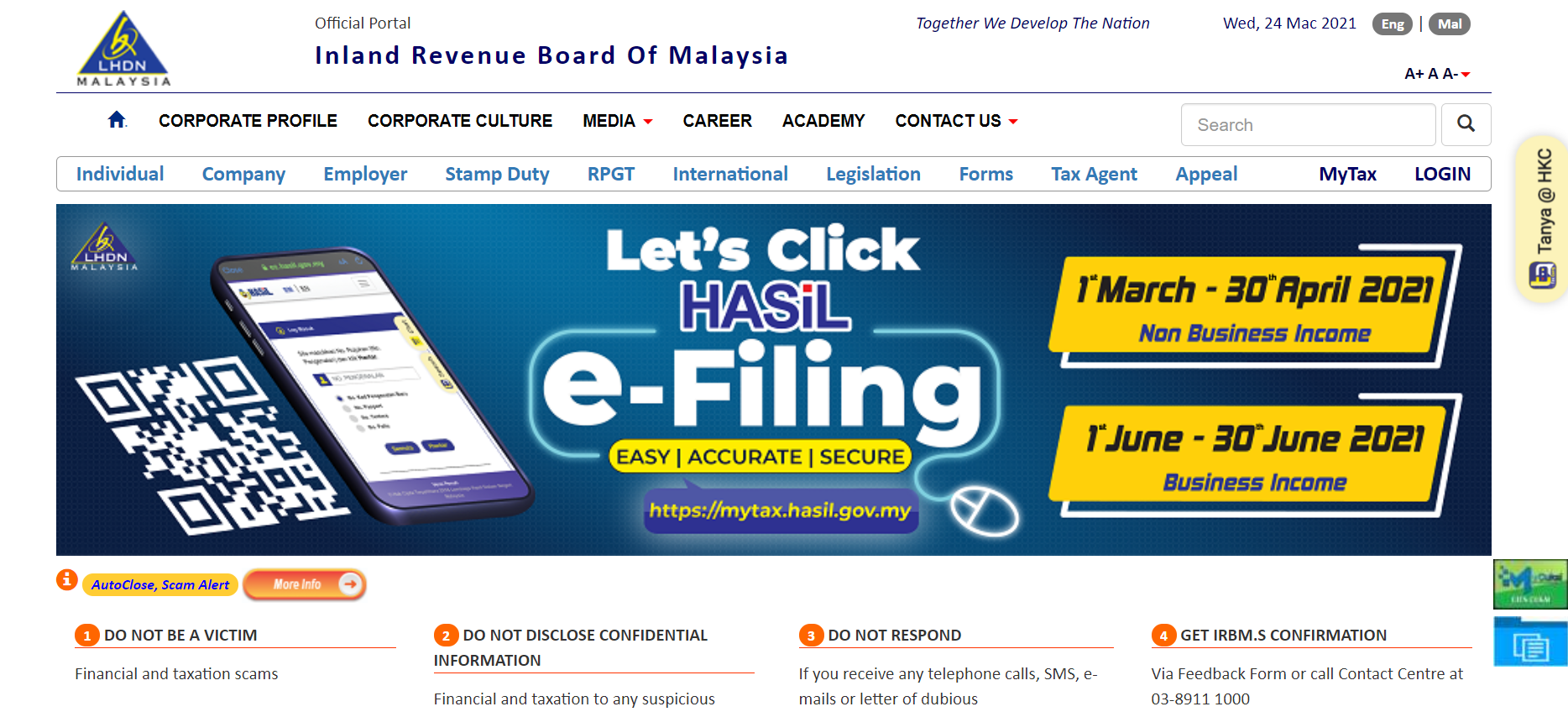

It is wise to file income tax even if the income ranges below the taxable income. Quick Guide to Tax Deductions for Donations and Gifts. Guide To Using LHDN e-Filing To File Your Income Tax.

Income tax is a tax imposed by the government on the income earned by individuals and businesses. Some states of the United States do not honor the provisions of tax treaties. How Does Monthly Tax Deduction Work In Malaysia.

According to the Income. How Does Monthly Tax Deduction Work In Malaysia. Additionally consider filing a tax extension and e-file your return by the October deadlineCheck the PENALTYucator for detailed tax penalty fees.

Income Tax SlabBrackets Applicable for FY 2019-20. Therefore you should consult the tax authorities of the state from which you derive income to find out whether any state tax applies to any of your income. If the taxpayer is required to remit two advance payments on the accrued income tax then the first advance payment is due within a period not exceeding 30 days from the.

If you want to make changes after the original tax return has been filed you must file an amended tax return using a special form called the 1040-X entering the corrected information and explaining why you are changing what was reported on your original return. Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file. Tax Offences And Penalties In Malaysia.

Discussed below are some reasons why a person should consider filling ITR. If gross income exceeded JOD 1 million then the taxpayer is required to remit two advance payments on the accrued income tax using certain rates applied for each tax period. Income Tax Malaysia.

One must file an income tax return to justify hisher income. It is a highly alluring career in civil services and numerous people appear for the examination. How To Pay Your Income Tax In Malaysia.

In this regard to avail tax advantages to its fullest it is crucial to understand the existing income tax slab for the fiscal year. How To Pay Your Income Tax In Malaysia. The complete texts of the following tax treaty documents are available in Adobe PDF format.

For those who have yet to file and would like yet another tip on how to cut down on the chargeable income this could help. Overpaid Taxes Can Be Refunded In The Form Of A Tax Return. Guide To Using LHDN e-Filing To File Your Income Tax.

You dont have to redo your entire return either. ITR Help to Know Your Exemption Limit- In every financial year the limit to which income is taxable is updated by the finance minister of the country. This page provides links to tax treaties between the United States and particular countries.

How To Step By Step Income Tax E Filing Guide Imoney

The Complete Income Tax Guide 2022

Guide To Using Lhdn E Filing To File Your Income Tax

How To Step By Step Income Tax E Filing Guide Imoney

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

How To Step By Step Income Tax E Filing Guide Imoney

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

7 Tips To File Malaysian Income Tax For Beginners

Guide To Using Lhdn E Filing To File Your Income Tax

How To File For Income Tax Online Auto Calculate For You

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

7 Tips To File Malaysian Income Tax For Beginners

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

How To File Your Taxes For The First Time

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Malaysia Personal Income Tax Guide 2021 Ya 2020